UPDATE: I’ve been contacted by PNC’s social media department and they want to help. I’m grateful for them reaching out and I look forward to speaking with them soon.

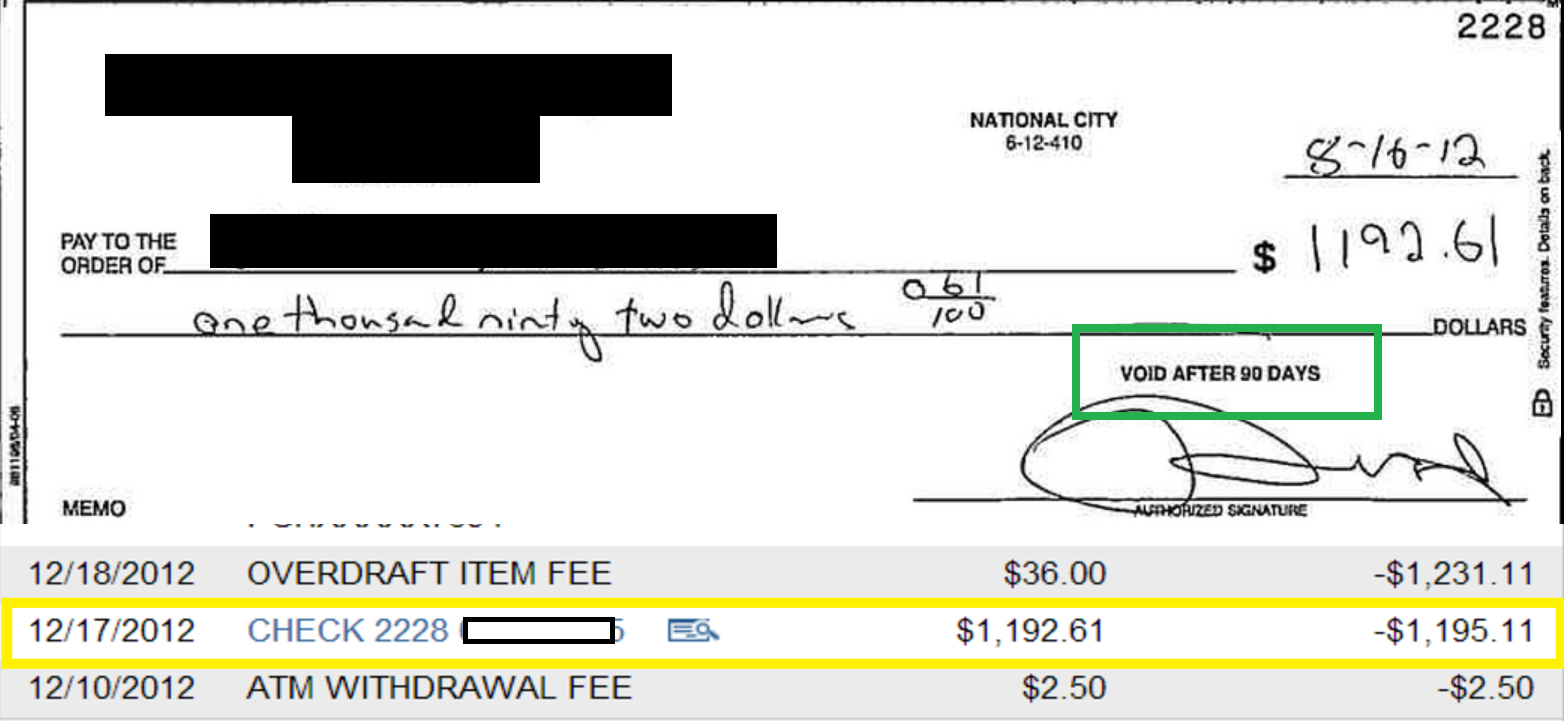

UPDATE 2: It was suggested that I post a transmogrified copy of the check along with the date it was cashed. Here you go. Please notice that date on the check, the date it was cashed and the “void after 90 days”. PNC informed me that they don’t honor the “Void after 90 days”. If that’s the case, what’s the point of having it on there?

I don’t make it a habit of using this blog to call attention to issues I’m having with a business or company. However, every once in awhile, we are impacted so severely by something that I feel I need to bring it to light. Especially, when I have been trying to address the issues through proper channels and get rebuffed.

PNC Bank is going to be on the receiving end of things for once.

I’ve written about this a few times lately but I’ve not directed things publically to PNC. That’s about to change.

Last year, I opted out of overdraft protection because we were finding ourselves overdrawn on too many occasions. That’s my fault and I accept responsibility for that.

However, I wanted to make sure that we weren’t going to continue bleeding to death due to overdraft fees. Between removing the overdraft protection and more diligence on my part, I felt that we were safer and could get ourselves back on track.

However, in December of 2012, PNC allowed an expired check to clear my account. That check was in the amount of $1,200, roughly. The balance in the account they let it clear from was only $2.43. Doing the math, you’ll find that the check was about $1,197 more than what I had in my account at the time.

I received a text message letting me know that my account was in the negative by almost $1,200.

I immediately contacted the bank and wanted to dispute the amount but I was told that the check would most likely bounce back due to insufficient funds. Besides, the amount was still pending and you can’t dispute a pending amount. Basically, I would get the fee for the bounced check but the check itself wouldn’t clear.

At that point, I contacted the company that had deposited the check to find out why in the world they did this. The check was written as one of a string of post dated checks meant to cover the repairs done to our old van, two weeks prior to it being stolen and totaled out.

The $1,200 was basically the last check of the batch. What was supposed to happen when they reached that particular check was that we would rip it up and spread out the payments further.

However, over the summer, we had a miscommunication and when our phone numbers changed, they couldn’t get a hold of me. Now, I’m pretty sure I gave them my new number, but either way, they weren’t being malicious. It was a mistake and one that they were more than willing to correct.

They told me to have the bank bounce the check back and they wouldn’t attempt to redeposit it.

I called PNC back and was told to wait and see if it actually cleared first. Again they said the check wouldn’t clear.

Guess what, the check cleared and PNC refused to bounce it back due to insufficient funds. They allowed a check to clear my account that was almost $1,200 more than I had available.………and I didn’t have overdraft protection either………and the check clearly stated on it that it was void after 90 days. We were well outside of the 90 days by then. That doesn’t seem to matter. None of it does.

After the check cleared the account, I officially disputed the transaction. I was told that we were requesting that the check be bounced back. I was also told that I would not be getting a provisional credit due to the amount.

My understanding was that PNC was going to bounce the check back and the check wouldn’t be redeposited. If the money reappeared into my account, that would be because everything went through as planned.

A few days later I was relieved to see the money back in my account. I was able to cut payroll for the business and I was preparing to make a payment on our mortgage. Out of nowhere and without notice, the $1,200 disappeared from my account once again. This time, right before my direct deposit was supposed to hit. I was once again over a $1,000 in the negative and when my $1,200 direct deposit was deposited, it basically canceled out the negative balance and I was left with nothing.

Turns out that PNC did give me a provisional credit. However, I was supposed to get a letter telling me that. If the credit was to be removed, I was supposed to get notice so that I could prepare. Again, I never heard anything from anyone.

At this point, I had lost between $2,200 – $2,400, not including overdraft fees and miscellaneous transactions that no one can explain.

This was the final blow that killed my business and forced me to close after 13 years. I was unable to cover payroll and my last contractor was forced to find work elsewhere. Who can blame him? I know I can’t.

To further make matters worse, during this whole debacle, PNC bounced back 2 checks from my other account. Those checks were automatic payments and amounted to only $60 total. There were insufficient funds for those to clear, that was my fault. However, my problem with that is, why let the $1,200 check clear and not the $60?

It makes no sense logically, unless you look at it from the angle of what benefits the bank more. They are likely to collect more fees from a $1,200 overdraft than they would a $60 one.

This is how they defended their actions.

They said that a computer decides what checks will clear and what checks will be kicked back for insufficient funds. They say it takes into account your history and standing with the bank and whether or not you have direct deposits going into that account. If that’s the case, I was a horrible investment. Last year, we lost well over $1,000 in overdraft fees alone. Most of that was my fault and I take responsibility for that.

However, I do have direct deposits going into that account and that’s why they allowed $1,200 check to clear. At least that’s my understanding.

But wait…..I have direct deposits going into the other account as well and they bounced those 2 $30 checks back. How does that make any sense? How is that consistent? Hold the phone, I didn’t have overdraft protection. How could the checks clear if I didn’t have overdraft protection? Apparently, overdraft protection only applies to debit and credit transactions and not checks. Who knew that? I certainly didn’t.

If the above is true, then why didn’t those other 2 checks for significantly less, clear? I’m confused by the inconsistencies here.

I mentioned earlier that I have tried going through the proper channels. I’ve gone through my branch manager and he even helped me file a formal complaint. I was supposed to hear back from that department, however, that never happened. Turns out they emailed the manager the next day and told him that I was without recourse. No one bothered to tell me that.

I’ve been waiting to hear back from someone that was never going to call me back.

Now they have taken to moving money between my accounts without my approval or consent. Them doing so has led to me overdrafting again because I had no knowledge or advanced warning of the transfers until my debit card was declined.

When I called to inquire, PNC says that they can move monies between my accounts, without my consent because I’m a sole proprietor and I had a negative balance in one of my accounts. Really?

The only reason I had the negative balance still is because I was waiting to hear back from PNC, telling me what had happened and what I needed to do.

Remember that phone call I was supposed to get but never came?

PNC, I can’t even begin to tell you how this has impacted my family. I realize and accept responsibility for the fact that I’m not well off and unfortunately for me (fortunately for you) I have a history of overdrafting. I’m doing the best I can inside of an impossibly difficult situation.

The bottom line is that it appears that your are picking and choosing what policies to enforce and when to do so.

Your bank has received what, around $7.6 billion in tax payer dollars during the bailout. I don’t know if you have paid that off yet or not but the point is, you are around today because of the American people.

What you have done to my family is not a good way to say thank you. I can only imagine how many others have fallen victim as well.

At this point, in part, due to your banks decisions, I’m in foreclosure. I have 3 special needs children and a chronically ill wife. The stress caused by this has done emence damage. I have been unable to pay bills or even buy groceries.

Much of the funds I lost during this period of time, were earmarked for house payments and our trips back and forth to the Cleveland Clinic for my wife.

Is it your fault that I’m behind in the first place? No its not. However, your actions have robbed us of the ability to bring our mortgage current. Not only that, but I can’t even put gas in the tank in order to take my son to school or my wife and kids to therapy and doctors appointments.

I trusted you with my family’s money and while it was never much, it’s what kept us afloat. I feel betrayed and robbed.

I have yet to get a satisfactory response from you and I’m no longer going to sit quietly and wait. They say that the squeaky wheel gets the grease. Well, I haven’t even begun to be squeaky yet.

I know that there are plenty of satisfied customers out there. I truly hope that we have simply fallen through the cracks. I can’t imagine this is how you do business.

I’m tired of contacting you. It’s your turn to contact me. You can do so through the link at the top of this page. I welcome any communication that helps to resolve this issue.

Please help me to make this right.

This site is managed via WordPress for Android, courtesy of the @SamsungMobileUS Galaxy Note 2 by @Tmobile. Please forgive any typos. I know how to spell but auto-correct hates me. 😉

For more ways to help the Lost and Tired family, please visit Help the Lost and Tired Family.

Quite honestly Rob, you lost my sympathy when I read about your 1K in previously accrued over-draft charges. Poor fiscal management is what is crushing your family, not PNC bank. Quit whining and get some help with your money management skills.

Nice to see that you are just full of compassion. I know I made a mistake and I own up to that. However, that isn't the point. The point is that there are supposed to be things in place to prevent this from happening. Each one of these things failed. I'm not looking for your sympathy, I was sharing this because PNC shouldn't have honored the check.

As far as money management goes, I know I could do better. I have a great deal on my plate and I'm doing the best I can. If you could walk a mile in my shoes and still keep on top of things, I tip my hat to you. 🙂

Rob,

I do have compassion for your family, I just don't believe in enabling the victim mentality. Had you not put yourself in such a precarious position financially, you may well have been able to weather this bank error (or perhaps even paid off the van in the first place). As for walking a mile in your shoes, well, been there, done that. 8 year old triples on the spectrum-one nonverbal, two aspies. Lupus/ESRD-me. Lost my wife in an MVA 4 years ago. I fully expect to be paying on medical bills till the day I drop. It sucks, but that's why it is absolutely incumbent upon families like ours to run a tight ship financially. Step up, take control and quit belly-aching!

I\’m sorry for your loss and applaud you ability to do better than I can.

I guess you and I just take different approaches to life and treat people differently. I try not to judge people because I don\’t know what their life is for them. Who am I to judge….

As I said, I tip my hat to you.

Also, I wasn\’t belly aching. What happened with PNC was wrong. The bank make a mistake. I\’m responsible my mistakes and so are they.

Rob, It looks like the check should never have gone through for any reason. The amount on the first line is different than the amount on the line where the amount is written out. how could they take the check when the two amounts don't agree?

Thank you Carol. I hadn't noticed that until you said something. I just let the bank know. 🙂

The bank should have honored the words, not the number is they don't match according to contact law.

I meant if someone were to try to cash a 2,000 check when you only had 800 bucks in your account it should be kicked back.

The check should have bounced. It does seem like an error on both parts, but the bank should have kicked that check back when they realized he didn't have the funds to cover it. If the computer is at fault then they need to come up with a new system.

If someone were to steal your wallet, write a check for 2,000 and deposit it into your account it should be kicked back. The banks don't do this because they know they will get money for charging you OD fees.

I have gone back and forth with PNC myself with issues. At one point, they were taking money out of MY account for someone else and didn't realize it until I went overdrawn and called to see WTF was going on. They then refunded my money of course, but still a problem that should have NEVER happened. I am actually in a dispute with them currently about just this same thing. My medical insurance quit paying for Sayge's occupational therapy so now I am a self-pay. This is $50 a visit, however, last week the therapist was late and so Sayge only got 15 mins of her 30 min visit. They assured me they were NOT going to cash the check until her next appointment (two weeks later) b/c they were going to talk to the owner of the company and let her know I would only be paying $25 for that visit due to the therapist being late. Now mind you, I had the money in the bank when I wrote the check, however, once they told me it would be two weeks until they would cash it I spent the money b/c I would get paid TWICE before that check cleared. And another note, the check was post dated two weeks from that day. They said they simply had to keep hold of the check to ensure I would be back. Anyhow, two days later the check was cashed, which of course bounced my account. I called them about it this morning and even told them the check was post dated so how could they cash it? To which they responded basically the same thing you stated above, its all computerized so they have no control over it. So I am currently in dispute with them over that as we speak. I called first thing this morning to dispute it, the girl told me I had to call after 4…I called at 4:30 this afternoon, the girl told me to call back first thing tomorrow morning! WTF?!?! Really??!?!

Another issue I had with them was an experiment I conducted not long after they had been taking money out of MY account for someone else's account. I wrote a check to my husband, who also has a PNC account. I did NOT sign this check ON PURPOSE to see as an experiment. My husband took it to the bank as normal and they CASHED the check WITHOUT my signature!! I called them again about the issue and got exactly the same response that it is all computerized now and they have no control over it.

I think after I solve my current problem with them I will be switching to another bank. Seems our money may be safe in our mattresses anymore. Even the banks are stealing from us to pay off their own debts apparently!

I have gone back and forth with PNC myself with issues. At one point, they were taking money out of MY account for someone else and didn't realize it until I went overdrawn and called to see WTF was going on. They then refunded my money of course, but still a problem that should have NEVER happened. I am actually in a dispute with them currently about just this same thing. My medical insurance quit paying for Sayge's occupational therapy so now I am a self-pay. This is $50 a visit, however, last week the therapist was late and so Sayge only got 15 mins of her 30 min visit. They assured me they were NOT going to cash the check until her next appointment (two weeks later) b/c they were going to talk to the owner of the company and let her know I would only be paying $25 for that visit due to the therapist being late. Now mind you, I had the money in the bank when I wrote the check, however, once they told me it would be two weeks until they would cash it I spent the money b/c I would get paid TWICE before that check cleared. And another note, the check was post dated two weeks from that day. They said they simply had to keep hold of the check to ensure I would be back. Anyhow, two days later the check was cashed, which of course bounced my account. I called them about it this morning and even told them the check was post dated so how could they cash it? To which they responded basically the same thing you stated above, its all computerized so they have no control over it. So I am currently in dispute with them over that as we speak. I called first thing this morning to dispute it, the girl told me I had to call after 4…I called at 4:30 this afternoon, the girl told me to call back first thing tomorrow morning! WTF?!?! Really??!?!

Another issue I had with them was an experiment I conducted not long after they had been taking money out of MY account for someone else's account. I wrote a check to my husband, who also has a PNC account. I did NOT sign this check ON PURPOSE to see as an experiment. My husband took it to the bank as normal and they CASHED the check WITHOUT my signature!! I called them again about the issue and got exactly the same response that it is all computerized now and they have no control over it.

I think after I solve my current problem with them I will be switching to another bank. Seems our money may be safe in our mattresses anymore. Even the banks are stealing from us to pay off their own debts apparently!

I have gone back and forth with PNC myself with issues. At one point, they were taking money out of MY account for someone else and didn't realize it until I went overdrawn and called to see WTF was going on. They then refunded my money of course, but still a problem that should have NEVER happened. I am actually in a dispute with them currently about just this same thing. My medical insurance quit paying for Sayge's occupational therapy so now I am a self-pay. This is $50 a visit, however, last week the therapist was late and so Sayge only got 15 mins of her 30 min visit. They assured me they were NOT going to cash the check until her next appointment (two weeks later) b/c they were going to talk to the owner of the company and let her know I would only be paying $25 for that visit due to the therapist being late. Now mind you, I had the money in the bank when I wrote the check, however, once they told me it would be two weeks until they would cash it I spent the money b/c I would get paid TWICE before that check cleared. And another note, the check was post dated two weeks from that day. They said they simply had to keep hold of the check to ensure I would be back. Anyhow, two days later the check was cashed, which of course bounced my account. I called them about it this morning and even told them the check was post dated so how could they cash it? To which they responded basically the same thing you stated above, its all computerized so they have no control over it. So I am currently in dispute with them over that as we speak. I called first thing this morning to dispute it, the girl told me I had to call after 4…I called at 4:30 this afternoon, the girl told me to call back first thing tomorrow morning! WTF?!?! Really??!?!

I have gone back and forth with PNC myself with issues. At one point, they were taking money out of MY account for someone else and didn't realize it until I went overdrawn and called to see WTF was going on. They then refunded my money of course, but still a problem that should have NEVER happened. I am actually in a dispute with them currently about just this same thing. My medical insurance quit paying for Sayge's occupational therapy so now I am a self-pay. This is $50 a visit, however, last week the therapist was late and so Sayge only got 15 mins of her 30 min visit. They assured me they were NOT going to cash the check until her next appointment (two weeks later) b/c they were going to talk to the owner of the company and let her know I would only be paying $25 for that visit due to the therapist being late. Now mind you, I had the money in the bank when I wrote the check, however, once they told me it would be two weeks until they would cash it I spent the money b/c I would get paid TWICE before that check cleared. And another note, the check was post dated two weeks from that day. They said they simply had to keep hold of the check to ensure I would be back. Anyhow, two days later the check was cashed, which of course bounced my account. I called them about it this morning and even told them the check was post dated so how could they cash it? To which they responded basically the same thing you stated above, its all computerized so they have no control over it. So I am currently in dispute with them over that as we speak. I called first thing this morning to dispute it, the girl told me I had to call after 4…I called at 4:30 this afternoon, the girl told me to call back first thing tomorrow morning! WTF?!?! Really??!?!

Another time I conducted an experiment with this bank. I actually wrote a check to my husband (just as an experiment b/c I thought something fishy was going on) anyway, I wrote this check to my husband, I didn't sign the bottom of the check. He took it in there (he also has a PNC account) THEY CASHED IT! The check was NOT signed! I called them about this issue and got the same response as before, its all computerized. Basically they were telling me that someone can steal my checks and write the whole book of them and it didn't matter.

Anyhow, I feel you on this issue and after this little problem I think I will be switching banks. I think that this bank is VERY poorly run.

Your right. I didn't expect them to refund the amount. They couldn't do that anyway after the check cleared. They were simply going to allow the check to bounce back and stretch out the payments, as originally planned. Honestly, it would be bad business for them to refund, No Thanks is correct.

However, they knew I was good for it and they were working with me because they knew that. The repairs on the van were not done right anyways but before I could get the van back in to the shop, it was stolen. Plus this company is just really good with people and they have been working with us. Ironically, that's why the car thieves didn't get very far when they stole it, it stalled out on them. However, they managed to destroy it before it stalled. Kinda poetic justice I suppose.

I totally agree. I just thought that since they were willing to tear up the check if it had been bounced back to them as Rob mentioned, then they might be willing to give the money back since they admitted that it was their fault for cashing the check.

Rob-

Anytime you write a check when you don't have money in the account to cover, it's a crime. I know that the repair shop wanted it in order to let you finance, but the bottom line is anytime you write a check without sufficient funds, it's illegal. In Ohio, it's considered a "bad check" and when it's over $1000 this is what you face: "The misdemeanor carries a $1,000 fine, and is punishable with up to six months jail time". This isn't flexible…you don't get to say "I didn't mean for the check to be cashed" or "this is all a misunderstanding" or "we're a special needs family". The law applies to everyone equally.

It seems like PNC may have honored the first overdrawn check (as a courtesy) so that you didn't run into legal trouble, and rejected subsequent checks when they realized you didn't intend for them to be cashed. While it's an inconvenience, you're kind of lucky this didn't manifest into unanticipated consequences.

Dude,

I wrote the check over a year ago. I wrote out checks to cover the payments for most of the 2012 in advance. The last check was there as sorta of a balloon payment. The agreement I had with the shop was that when we reached that check, I would go in, rip that check up and spread the payments out further.

My son spent most of the summer in the hospital and I lost track of where we were on the payments. They were unable to get a hold of me and so they eventually cashed the check. You are way overreaching by referring to this as fraud. That's not at all what happened. You didn't read this carefully or perhaps I wasn't clear. This was a payment plan that I lost track of. No one is looking at this as fraud because that isn't what happened. The people that cashed the check know that it wasn't fraud as does the bank.

The only issue at hand here is that PNC honored the a check that had expired and overdrew an account that had no overdraft protection.

I appreciate your well spoken comment but not your misguided assumptions.

Rob, the only leg you have to stand on is the fact that the check was expired. That's it. Everything else that you mention in your post to PNC is irrelevant and honestly, it sort of clouds the issue and makes you seem like you are blaming everyone but yourself (yes i know you technically "take responsibility, but it's clear that you don't, or you wouldn't be writing this). I'm not saying you don't deserve the funds back – if the check was truly expired and void, you have a very clear and reasonable case. But the bank doesn't care about your arrangement with the repair shop, or the fact that you are a special needs family. Truthfully, if the check had been valid i would have ABSOLUTELY sided with the bank – as it's your job to keep track of your finances – family obligations or not. Do you have a copy of the check you can post? So that everyone can see it was void? maybe that would help your case.

Do you seriously think Rob is stupid enough to post a copy of a check with all his information on it just to prove a point to somebody who is missing the whole point of this blog post?

I actually posted a transmogrified copy above. No personal information. 🙂

I posted the check above.

There's a part of this story that I'm not understanding at all. Why are you out $2400? What is the direct deposit? Is that what you paid your contractors? I've re-read the post several times and still can't figure out how the direct deposit CANCELED OUT the negative balance, yet you are out twice the amount of $. Something just isn't adding up.

Okay, to me it was losing $2400. When the check cleared, I was $1200 in the hole. I realize I wrote the check and I owed the money anyway, but I had planned on making payments over the rest of the year, like we had agreed to. I got side tracked and I take responsibility for that. The repair shop didn't have the right number to reach me at so we had a break in communication. To me, that was the first $1200 loss.

The second $1200 came when my paycheck was direct deposited into that account. The paycheck was roughly $1200 and it went into an account that was -1200. They basically canceled each other out. Make sense?

I realize that I would have owed the money anyway and again, I accept responsibility. My whole issue is the way this was handled. I have never written a bad check, especially with the intention of committing fraud, as suggested above. I opted out of overdraft protection long before this. I didn't want anything like this to happen. My understanding was that NOTHING would be allowed to go through, if the funds weren't available. I chose to do that, at least until we could get back on our feet.

At no point was I told that overdraft protection didn't apply to checks.

I don't think that I came across correctly in the post. Even the branch manager was trying to help fight this because this shouldn't have happened.

Why doesn't the repair shop just give you back the $1200 that they received after cashing your check? Wouldn't that be like ripping up the check in the first place–minus fees of course?